Retro pay calculator with overtime

Ad Create professional looking paystubs. See the Payroll Tools your competitors are already using - Start Now.

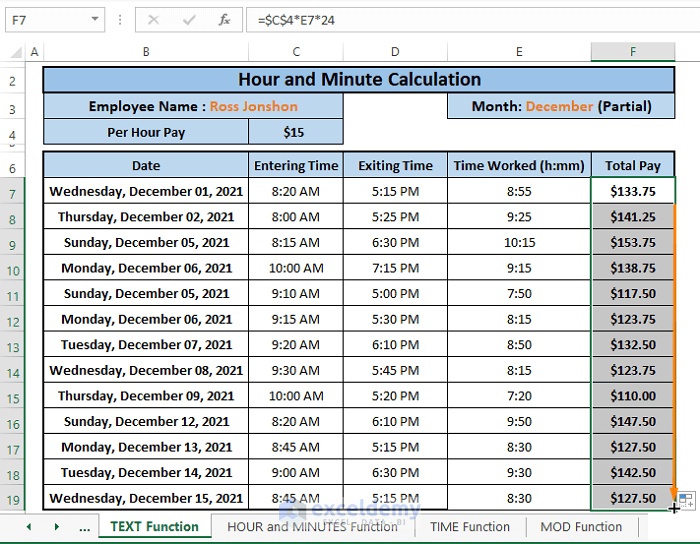

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

Lets work with an example.

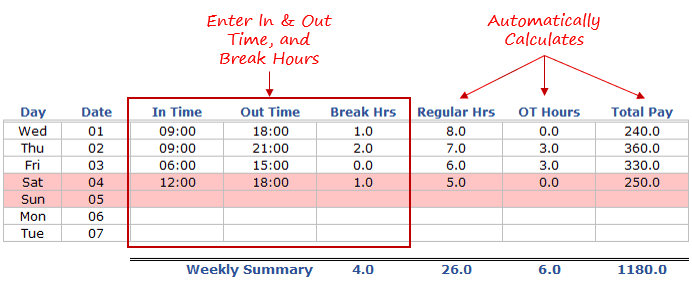

. In case someone works in a week a number of 40 regular hours at a pay rate of 10hour plus an 15 overtime hours paid as double time the following figures will result. In a few easy steps you can create your own paystubs and have them sent to your email. I have reviewed the above calculation and agree that the amount of.

The form will automatically calculate the overtime amount if the Required Information is entered online. When the payroll system fails. May 1 2022 - Uncategorized - by - Comments Off on retro pay calculator with overtime.

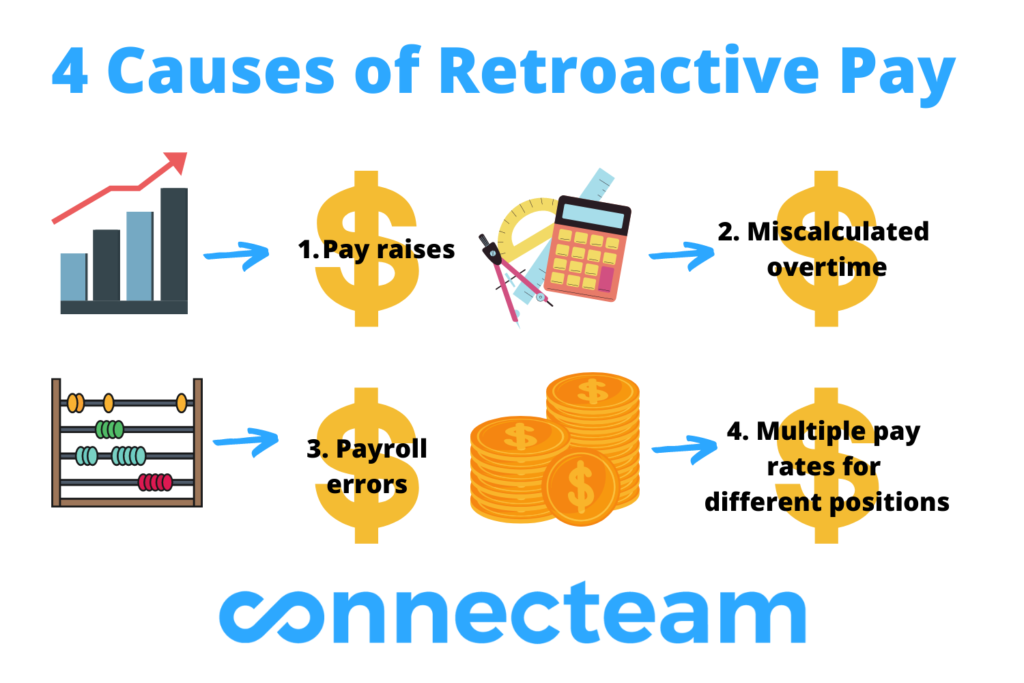

The first step to calculate the correct retro pay for an. You give them a 5000 pay raise which brings their salary to. Take a Guided Tour Today.

You calculate retro pay by determining the difference between the pay rate that was paid vs the pay. Pay Periods and Interest. How you calculate retro pay depends on how you classify the employee affectedretro pay is computed differently for salaried employees and hourly employees.

First day of first pay period. To calculate retro pay we need to consider several aspects including the type of salary the duration of the payroll misstep and the possibility of employee overtime. Finally calculate the retro pay by subtracting the amount you.

Unless specifically exempted employees covered by the Act must receive overtime pay for hours worked in excess of 40 in a workweek at a rate not less than time and one-half their regular. See How Paycor Fits Your Business. See How Paycor Fits Your Business.

Ad GetApp has the Tools you need to stay ahead of the competition. You can follow these steps to calculate retro pay. Number of days in employees pay period.

You pay your employee 40000 per year. How to calculate retro pay for salaried employees. The next step is to calculate the amount you should pay the employee after the raise.

You can rapidly calculate retroactive pay for hourly workers salaried employees and even flat-rate amounts. 8 hours paid incorrectly x 50 shift differential 4 gross retro pay due. 27 overtime pay rate 18 regular pay rate x 15 overtime rate.

Depending on the business and where it is located it may be required to adhere to different overtime compensation rules. Number of days between end of pay period and date that paychecks are issued. We use the most recent and accurate information.

Consider if the pay is hourly or salaried. Ad Paycors All-In-One HR Solution Streamlines Every Aspect Of Your Organization. Ad Paycors All-In-One HR Solution Streamlines Every Aspect Of Your Organization.

How to calculate retro pay. The amount should be 1730 4500026. Take a Guided Tour Today.

Overtime pay is not taken into account.

Calculating Retroactive Pay

Calculating Retroactive Pay Youtube

Calculating Retroactive Pay

What Retroactive Pay Is How To Calculate It Connecteam

What Is Retroactive Pay And How To Calculate It Hourly Inc

Process Retroactive Payroll

Calculating Retroactive Pay

Retroactive Wage Calculation Youtube

How To Calculate Retroactive Pay Payroll Management Inc

Excel Timesheet Calculator Template For 2022 Free Download

Process Retroactive Payroll

Calculating Retroactive Pay

Calculating Retroactive Pay

Calculating Retroactive Pay

How To Calculate Process Retroactive Pay Free Calculator

Calculating Retroactive Pay

What Is Retro Pay Shortlister