Home equity with poor credit

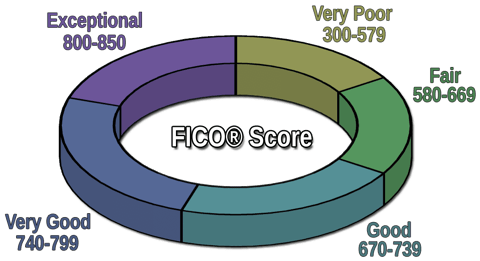

What if I want to get a home equity line of credit with bad credit. Your credit score is one of the key factors in qualifying for a home equity loan or a home equity line of credit HELOC.

Private First Mortgage Home Equity Loan Second Mortgage Mortgage

Now in 2021 you can get a mortgage at an interest rate of 3.

. Each lender sets its own borrowing criteria annual borrowing limits interest rates and repayment terms. Developing countries are in general countries that have not achieved a significant degree of industrialization relative to their populations and have in most cases a medium to low standard of livingThere is an association between low income and high population growth. A FICO score of at least 680 is typically required to qualify for home equity loans according to Experian one of the three major credit.

After that time the balance must be. Development can be measured by economic or human factors. However borrowers with credit scores as low as 500 but with home equity of 10 percent or more may be approved for refinancing.

The 2017 Tax Cuts and Jobs Act allows homeowners to deduct the interest on home equity loans or lines of credit if the money is used for capital improvements such as to buy build or. Home equity loans allow property owners to borrow against the debt-free value of their homes. Why Connexus Credit Union is the best home equity loan for a branch network.

There are several ways you can get access to your home equity whether through a cash-out refinance or home equity loan home equity line of credit or reverse mortgage. Where home price trends are strong and the borrower has an excellent credit rating some lenders may allow borrowers to access up to 90 of a home. Helping you the consumer.

The development of a country is measured. Having poor credit means you. Loan Pioneer works with people good as well as fair poor and even bad credit scores to help them get quick access to 5000 or less cash.

Signed a Purchase Agreement. Shopping can help you get better terms and a better deal which is important when the financing is secured by the value of your home. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Mortgage loan basics Basic concepts and legal regulation. Refinance Your Current Mobile Home. Private Equity and COVID-19 By.

Getting a mobile home equity loan or line of credit HELOC for manufactured homes is hard but these lenders can help with mobile home equity loans. Home equity lenders like traditional mortgage lenders are interested in ensuring your ability to repay the loan. The demand for mobile home equity lines of credit and loans has surged in 2020.

Principal interest taxes and. Financial services are the economic services provided by the finance industry which encompasses a broad range of businesses that manage money including credit unions banks credit-card companies insurance companies accountancy companies consumer-finance companies stock brokerages investment funds individual asset managers and some. The general rule is that you can afford a mortgage that is 2x to 25x your gross income.

These loans use your home as collateral. This is a case of being house rich and cash poor. Loan amounts for private student loans can vary by lender.

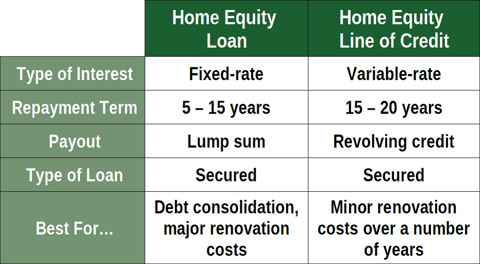

Another popular second mortgage option for tapping your homes equity is a home equity line of credit HELOC. The good news for people that have a manufactured or modular home is that the credit standards and rules are changing for fixed and HELOC loans and cash-back refinancing. The lower the score the more likely you are to be charged a higher interest rate.

If you want a better interest rate on that loan youll need excellent credit. Buying in 30 Days. When do you plan to purchase your home.

To get a home equity loan with bad credit youll likely have to have a low debt-to-income ratio DTI a high income and at least 15 percent equity in your home. Total monthly mortgage payments are typically made up of four components. Home equity loans for poor credit.

You replace your current mortgage with a bigger one and. Find out who does home equity loans on manufactured homes. If you have poor credit you may have a harder time getting approved.

Search the Ripoff Report before you do business with retail stores with bad return policies checking credit theft rebate fraud or other unscrupulous business policies such as phony auto repairs auto dealer bait-and-switch tactics restaurants with bad service or food corrupt government employees politicians police. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Compare financing offered by banks savings and loans credit unions and mortgage companies.

Offer Pending Found a House. Before applying for a home equity loan pull. Kaplan and Vladimir Mukharlyamov We survey more than 200 private equity PE managers from firms with 19 trillion of assets under management AUM about their portfolio performance decision-making and activities during the Covid-19 pandemic.

If youre thinking about getting a home equity loan or a home equity line of credit shop around. Buying in 2 to 3 Months. Keep in mind that too much leverage from existing debts and poor credit history may harm your ability to obtain another loan.

Private student loan amounts. They will use your income information debt-to-income ratio and proof of assets to underwrite your loan. With the FHA streamline refinance program.

A home equity line of credit is a popular way for homeowners to finance repairs. A HELOC works like a credit card for a set time called a draw period during which you can borrow from your credit line. Home equity loans disburse a lump sum of money upfront which you pay back in fixed monthly installments.

A cash-out refinance allows you to take out your equity by getting a new mortgage with a higher loan amount. Gompers Steven N. I generally recommend you.

Getting a home equity loan with bad credit. If you have bad credit you may still be able to get a home equity loan since the loan is backed by. This would mean that if a lender has a max LTV of 80 a borrower could borrow up to an additional 25 of the value of the home 50000 via either a home equity loan or a home equity line of credit.

Lets say that 10 years ago when you first purchased your home interest rates were 5 on your 30-year fixed-rate mortgage. These options include the home equity line of credit or HELOC which allows you to borrow against the equity in your home as well as a home equity loan.

Hip Roof Colonial At Christmas Home Loans Home Equity Loan Home Mortgage

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Discover Home Equity Loans Home Improvement Loans Home Equity Loan Home Equity

Pre Approved Car Loans For Bad Credit Helps Bad Credit Car Buyers To Get Behind The Wheel

Pin On Pinterest Real Estate Group Board

What Are Mortgage Points And Why Are They So Important Mortgage Mortgage Tips Mortgage Payoff

Homeowners Are Sitting On A Record 6 Trillion In Equity Why Aren T They Using It Home Equity Equity Line Of Credit

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

If You Want To Pay Off Your Mortgage Early In Five To Seven Years You Can Using A Simple Home Equity Line Of Credit Also C Line Of Credit Home Equity Heloc

Equity Mortgage Home Equity Equity Line Of Credit

5 Debt Management Tips Loans For Bad Credit No Credit Loans Bad Credit

Pin On Home Loans

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Home Equity Loan Vs Personal Loan Which Is Better For You Home Equity Loan Personal Loans Home Equity

3 Home Equity Loans For Bad Credit 2022 Badcredit Org